Today’s tutorial is all about calculating your customer lifetime value for your eCom business.

This is a very important metric to figure out, because it helps you to understand:

- How much you should be spending to acquire a customer

- How much a customer is worth on average to your business

If you plan on running any ads to acquire customers, you need to know your profit margin from your average customer lifetime value. Knowing this figure will help you to understand how to remain profitable with your paid acquisition.

What Is Customer Lifetime Value?

In simple terms, customer lifetime value is:

- The amount of revenue your customer will spend with you and your business over the lifetime that they are a customer.

- You can calculate lifetime value over 3, 6, 12 months or more, to help you understand what revenue on average you generate from your customer during these time periods.

- Figuring out the average profit margin on your LTV will help you to figure out how much you should be spending to acquire a customer for your store.

How To Calculate LTV?

Calculating LTV is pretty straight forward. The formula for calculating this important metric is as follows –

Formula

LTV = (Number of repeat transactions) X (Average Order Value) X (AVG. Retention Time)

This calculation will provide you with how much each customer is worth to you in terms of revenue. You can focus on specific time periods such as 3, 6 or 12 months when calculating LTV of a customer.

Let’s take a look at an example…

How To Calculate Repeat Transactions

In order to calculate the number of repeat transactions within your eCom store, here is the formula below:

Total number of orders within a specific time period / Total number of customers within the same specific time period.

We work with 12 months for this example –

Example:

1000 orders / 568 customers = 1.76 per customer for a 12 month period

How To Calculate Average Order Value

To calculate the average order value within your eCom store, here is the formula below:

Total revenue within a specific time period / total amount of orders within the same specific time period = Average order value

Example:

$120,000 in revenue over 12 months / 1900 orders over the same 12 month period = $63.16 Average order value.

Average Retention Rate

To calculate average retention rate, you’ll need to have previous transaction history to calculate correctly.

If you don’t have previous transaction history, you can take a conservative estimate.

If you don’t have previous transaction data and customers etc, you can always use a 3, 6 or 12 month benchmark to include in the formula.

For our example we’ll use a 2 year retention time rate.

Calculating LTV

Let’s put our numbers together based on what we have calculated in this presentations so far:

- Number of Repeat Transactions = 1.76

- Average Order Value = $63.16

- Average Retention Time = 2 years

Number of Repeat Transactions (1.76) X Average Order Value ($63.16) X Average Retention Time (2 years) = $222.32

$222.32 is the figure we can expect to generate per customer over the average lifetime (2 years) of the customer relationship.

How To Calculate Profit

So now that we know what our LTV is on a customer over two years ($222.32 from slide 8). What we don’t know is what the profit is on this value.

To calculate the average profit of our lifetime value, we use the following formula below:

Customer LTV x Average Margin = Average Profit on LTV

Example:

$222.32 (24 month revenue return) x .50 (%) = $111.16 Average Profit on LTV

How We Determine What To Pay When Acquiring Customers

What we like to do when calculating LTV through paid acquisition is look at some numbers within the data that have been acquired already from our clients customers.

Let’s say we want to calculate our average LTV of our clients customers over a 3 month time period. The reason for this is because we want to figure out how much revenue we’re making on average from our customers for that period of time.

When we get that figure and calculate the average profit margin, this will help us to determine what we can pay to acquire a customer.

We like to work with the formula below:

Total Revenue from Customers within a specific time period / Number of Customers Generated within the same specific time period

= Average Revenue Per Customer (ARPC)

ARPC tells us what the average revenue is per customer over a specific period of time.

Example:

$30,000 Total Revenue from customers (over a 3 month period) / 1200 Number of Customers Generated (over the same 3 month period) = $25 average revenue per customer

If we generate $25 on average from a customer over a 3 month period and our average profit margin after cost of goods sold is at 50%, that gives us $12.50 we can use to acquire a customer.

All we got to do is keep our cost per acquisition below this figure of $12.50 and we’re in profit after 3 months.

Example:

If we typically acquire a new customer @ $10, we know that we are making a 2.5 X revenue return on average over the next 3 months that follow. ($25 on average from our customers). We’re also $2.50 in profit from our acquisition costs.

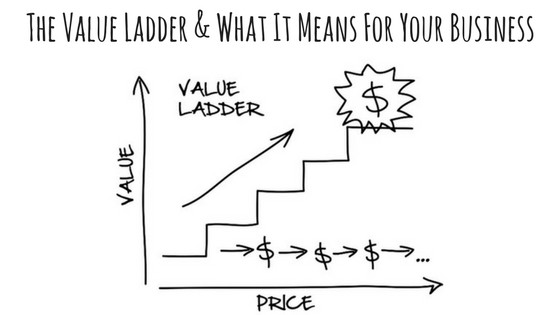

If we extend that out further it becomes more profitable…

After 6 months if we generate $50 revenue on average from a customer. Applying the same customer acquisition cost @ $10. We are making a 5 X revenue return on average from our customer acquisition.

Understanding these numbers, we can get more aggressive with our customer acquisition and scale things up by buying more traffic and understanding that as we get customers for $10, they are returning on average $50 after 6 months.

Moving Forward With Customer Acquisition

These calculations help you massively because you now know what revenue you can expect to make on average from your customer base.

More importantly… the profit you are generating after cost of goods sold gives you a figure to work with for your customer acquisition cost.

Example:

If we use the previous example of average profit made after 3 months ($12.50). Acquiring a customer for less than $12.50 gets us off to a great start with a store.

Over the months and years that follow, the revenue and profit on average per customer will grow as we continue to use remarketing channels like email and ad buyer retargeting lists.

E.g – $222.32 in revenue and $111.16 in profit (after 24 months)